XRP Price Prediction: $7-$10 Target in Sight as Bullish Signals Align

#XRP

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

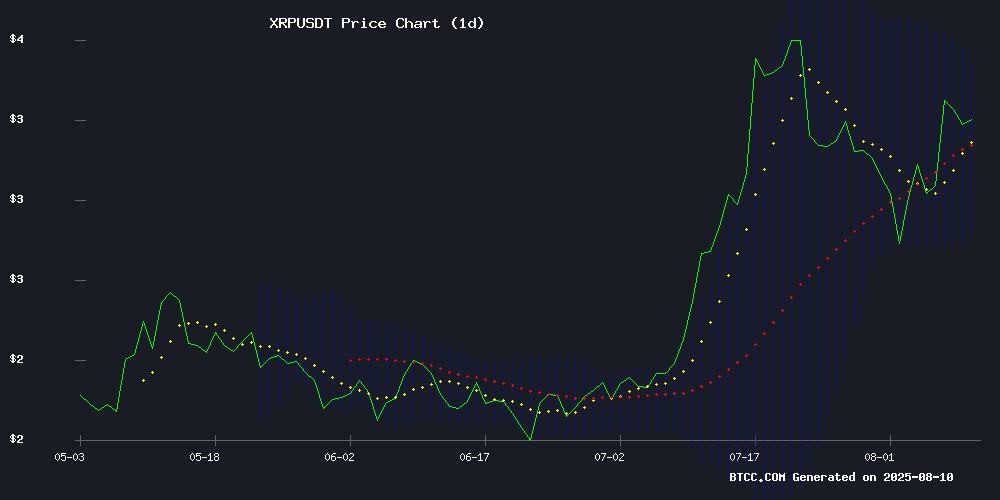

XRP is currently trading at $3.1865, above its 20-day moving average of $3.1259, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 0.0486, suggesting upward momentum. Bollinger Bands reveal the price is NEAR the middle band, with potential to test the upper band at $3.4487. BTCC financial analyst Ava notes, 'The technical setup favors further gains, with key support at $2.8032.'

XRP Market Sentiment: Legal Clarity Fuels Optimism

The resolution of the SEC lawsuit and removal of Ripple's 'bad actor' tag have significantly boosted market confidence. Headlines highlight institutional interest, with VivoPower's acquisition and a $200M XRP fundraise by Digital Wealth Partners. BTCC financial analyst Ava states, 'The combination of legal clarity and growing institutional adoption could propel XRP toward $5-$10 targets.'

Factors Influencing XRP’s Price

XRP Price Prediction as SEC Drops Ripple’s ‘Bad Actor’ Tag

Ripple has secured another significant victory in its protracted legal battle with the U.S. Securities and Exchange Commission. Both parties have filed to dismiss their appeals, effectively concluding the nearly five-year court saga. The SEC has granted Ripple a waiver from its "Bad Actor" disqualification, removing a major regulatory hurdle that had constrained the company's ability to raise capital. This waiver allows Ripple to conduct exempt securities offerings and attract investors without additional barriers.

The SEC's decision, while not lifting the permanent injunction, alleviates one of the heaviest legal burdens on Ripple. Market participants view this as the next best outcome to a full legal clearance, signaling improved regulatory standing for the company. Ripple now has a clearer path for expansion, partnerships, and fundraising—opportunities that were previously complicated by the lawsuit.

XRP's price reaction reflects renewed market optimism. The waiver underscores Ripple's resilience and could catalyze further institutional interest in the cryptocurrency.

VivoPower Strengthens Digital Portfolio with Ripple Share Acquisition

VivoPower, a Nasdaq-listed company, is making a strategic move into digital assets by acquiring $100 million worth of shares in Ripple. This investment provides indirect exposure to XRP, one of the largest cryptocurrencies by market capitalization. Ripple remains the primary holder of XRP tokens, positioning VivoPower to benefit from potential future appreciation.

The company's management emphasized diversification and long-term growth potential, stating the investment aligns with XRP's current market valuation of $0.47 per token. This move signals growing institutional interest in cryptocurrency markets, particularly through indirect investment vehicles.

XRP Price Struggles Amid Technical Resistance While Remittix Gains Attention

XRP faces renewed pressure near the $3.00 level, with technical indicators suggesting potential downside. A double-top pattern at $3.60 and declining trading volume point toward a possible retracement to $2.50. Meanwhile, daily active addresses have dwindled to 30,000, far below Q1 2025 peaks.

Whale activity compounds the bearish sentiment—reports indicate XRP co-founder Chris Larsen is reducing his holdings. The token's $164 billion market cap leaves limited room for exponential growth compared to emerging projects with clearer utility cases.

Attention is shifting toward Remittix, a new entrant demonstrating real-world application in crypto-to-fiat transactions. Its infrastructure targets high-demand remittance corridors, positioning it as a potential disruptor in cross-border payments—a sector where XRP's institutional adoption narrative remains unfulfilled.

XRP Faces Key Resistance Despite Bullish Breakout Attempt

XRP's 11% surge on Thursday sparked optimism among bulls, with the cryptocurrency appearing to break out of a bull flag pattern. Yet the celebration may be premature—prices remain firmly capped below the critical $3.65 level where a bearish tweezer top formation crystallized last month.

This technical rejection pattern signals exhaustion, evidenced by two failed attempts to breach resistance at identical price points. Historical on-chain metrics compound the concern: NUPL data reveals profit-taking incentives mirroring 2018 and 2021 market peaks, periods that preceded significant corrections.

The path forward hinges on conquering layered resistance at $3.38 and $3.65, though Alphractal's research suggests holders may liquidate positions before such milestones are achieved. Market structure now presents a classic standoff—technical sellers defending resistance versus momentum traders betting on continuation.

XRP Poised for Final Bullish Surge: Analyst Predicts $7-$10 Target

XRP's price trajectory appears primed for a decisive upward move, with technical analysis pointing to a potential surge to $7-$10. The cryptocurrency has completed its Wave 3 rally—a 575% ascent from $0.50 to $3.39—and weathered the subsequent Wave 4 correction that brought prices down to $1.60.

Market observers now detect early signals of Wave 5 formation, the terminal phase in Elliott Wave Theory's five-stage cycle. Recent price action saw XRP rebound from $1.60 to $3.66, suggesting accumulating momentum for this final push. At projected targets, XRP's market capitalization would exceed $400 billion—a threshold that would cement its position among crypto's elite assets.

The analysis hinges on historical patterns where Wave 5 extensions frequently achieve 1.618 times the length of Wave 3. For XRP, this technical measurement aligns with the $7-$10 price band. Such a move would mirror the cryptocurrency's 2017 parabolic advance, though occurring within a more mature market structure.

XRP Price Rally Ahead? Key Metric Flashes Signal Seen Before Big Gains

XRP has held firm above the $3 level this week as a critical on-chain indicator triggered bullish sentiment. The Market Value to Realized Value (MVRV) ratio crossed above its 200-day moving average—a rare signal historically followed by substantial rallies.

Analyst Ali Martinez notes this "golden cross" preceded two prior surges: a 630% explosion and a 54% climb. The current setup mirrors those conditions, with conservative targets near $5.10 and aggressive scenarios eyeing $24.

The MVRV ratio, which tracks investor profitability, serves as a reliable sentiment gauge. Its breakout suggests accumulating confidence among holders. Market watchers now scrutinize whether history will repeat for the sixth-largest cryptocurrency.

Ripple vs SEC Lawsuit Ends While XRP Struggles at $3.5, But Primed to Reach $5

The SEC's long-running lawsuit against Ripple has concluded, with the company agreeing to a $125 million penalty and restrictions on unregistered institutional sales of XRP. This resolution removes a major regulatory overhang, injecting fresh optimism into the market.

XRP surged immediately after the announcement, breaking key resistance levels. Technical indicators suggest a bullish bias, with the $3.36–$3.63 resistance zone now in focus. A confirmed breakout could propel the token toward $4.20.

Market volatility is returning, as evidenced by Bollinger Band expansion. The $3.15 level serves as critical support—holding this floor may determine whether XRP challenges its next upside target or retreats toward $2.78.

Digital Wealth Partners Raises $200M in XRP to Boost Investment Funds

Digital Wealth Partners Management (DWP Management) has secured approximately $200 million in capital across its fund strategies since April, with all in-kind contributions made exclusively in XRP. This move underscores institutional confidence in the token and signals growing demand for crypto-native investment vehicles.

The capital call spans multiple strategies, highlighting XRP's operational role within DWP's funds. While deployment details remain undisclosed, the firm's MOVE framework suggests broader acceptance of digital assets in professional portfolios—a trend accelerating as traditional finance warms to blockchain-based solutions.

Ripple Clears Major SEC Hurdle: Could This Spark a New XRP Expansion?

Ripple has regained access to private fundraising after the U.S. Securities and Exchange Commission granted a regulatory waiver. The decision removes the company's "bad actor" designation, restoring its ability to raise capital under Regulation D exemptions. This marks a pivotal shift in Ripple's legal standing and operational flexibility.

The SEC lifted a five-year restriction that had blocked Ripple from using private placement exemptions. These exemptions allow companies to raise unlimited funds from accredited investors without full SEC registration. Judge Analisa Torres' prior ruling had left Ripple with costlier fundraising routes—now eliminated by the waiver.

Several publicly listed companies recently disclosed XRP holdings alongside other cryptocurrencies. Ripple's restored fundraising capacity could accelerate its pursuit of a national bank charter, signaling broader institutional acceptance.

Ripple vs SEC Case Concludes, Paving Way for XRP ETF Surge

The landmark Ripple vs SEC lawsuit has reached its conclusion after nearly five years of litigation, setting a precedent for cryptocurrency regulation. With the legal uncertainty lifted, market confidence in XRP has surged, reflected in a 77% probability of ETF approval. Institutional interest is accelerating, with Grayscale, Bitwise, and WisdomTree leading the charge with filed applications. Speculation mounts that BlackRock may soon join the fray.

The SEC's 2020 lawsuit accused Ripple of selling $1.3 billion in unregistered securities. Key turning points included the 2022 court order compelling the SEC to release internal documents, particularly the Hinman emails, which shed light on the agency's stance toward major cryptocurrencies. This transparency proved pivotal in shaping the case's outcome.

XRP Defies Market Challenges as Ripple and SEC Resolve Legal Battle

XRP has weathered significant selling pressure, dropping to key support levels amid heightened volatility. The resolution of the protracted legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) marks a turning point for the cryptocurrency, injecting fresh momentum into its market dynamics.

Between August 8-9, XRP's price fell 5%, from $3.34 to $3.20, with a notable surge in selling volume during peak trading hours. Buyers aggressively defended the $3.20 support level, pushing the price back to $3.33. Analysts highlight $3.20 as critical support, with resistance firmly established between $3.31 and $3.33.

The conclusion of the five-year legal dispute between Ripple and the SEC, with both parties withdrawing appeals, has removed a major overhang on XRP. Market participants now eye potential upside as regulatory clarity emerges.

How High Will XRP Price Go?

Based on technical indicators and market sentiment, XRP shows strong potential for upward movement:

| Key Level | Price (USDT) |

|---|---|

| Current Price | 3.1865 |

| 20-Day MA Support | 3.1259 |

| Bollinger Upper Band | 3.4487 |

| Analyst Target (Short-Term) | 5.00 |

| Analyst Target (Long-Term) | 7-10 |

BTCC's Ava emphasizes: 'The breakout above $3.50 could accelerate gains, with $5 as the next psychological resistance.'

- Technical Strength: Price above MA + MACD bullish crossover

- Legal Catalyst: SEC lawsuit resolution removes regulatory overhang

- Institutional Demand: $200M fundraise signals growing adoption